How Much Tax In UAE

How Much Tax In UAE Taxation in the United Arab Emirates is one of the most complex and diverse systems in the world. With nine federal territories, over 100 dependent territories, and a population of almost 30 million people, the UAE’s tax system is vast and convoluted.

That’s why it’s important to have an experienced accountant on your team if you’re looking to do business in the UAE. They can help you navigate all of the twists and turns of this complex tax system. In this blog post, we’ll take a look at how much tax you may pay as a foreigner in the UAE, based on your income level and other factors.

What is Taxation in the UAE?

Taxation in the UAE is based on a Tax System where different taxes are levied on different levels of incomes. The Personal Income Tax Rate for individuals is currently at 10%. Businesses and other organizations are taxed at a rate of 25%.

There is also an Estate Duty, which applies to fortunes over AED5 million (USD1.3 million). Finally, there is a VAT (Value Added Tax) of 5% which applies to most goods and services purchased within the UAE. Alcoholic beverages, cigarettes and petrochemicals are all exempt from VAT.

How to Pay Taxes in the UAE?

In the UAE, taxes are paid by individuals and companies on their income. There are a number of ways to pay taxes in the UAE, including through the use of online tax software or through an accountant.

The amount of tax owed will depend on the income earned and any other factors that may be relevant. It is important to consult with an accountant or online tax software provider to calculate the correct amount of tax to be paid in the UAE.

What are the Different Types of Taxes in the UAE?

There are many types of taxes in the UAE, with different rates and thresholds depending on the income level and type of tax. The following is a list of the most common types of taxes in the UAE:

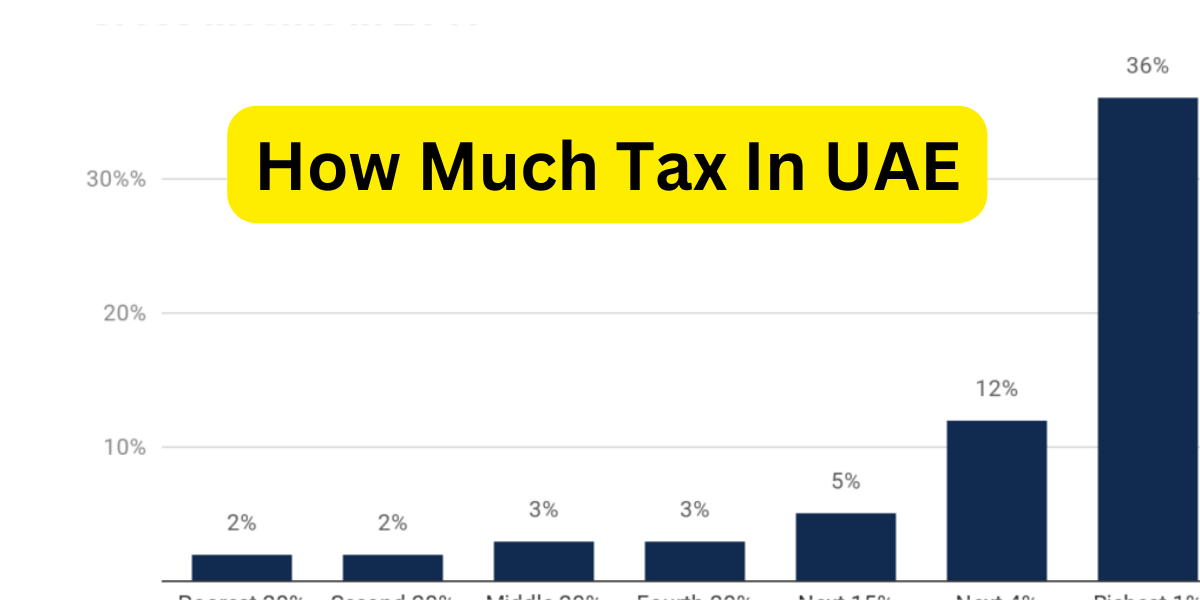

How Much Tax In UAE Personal Income Tax: This is a progressive tax system where higher incomes are taxed at a higher rate. The personal income tax rate for individuals is 10% for those earning less than AED 200,000 (US$56,000), 15% for those earning between AED 200,000 and AED 400,000 (US$86,000 to US$182,000), 25% for those earning more than AED 400,000 (US$182,000). There is also a social security contributions tax (SCCT) of 4%.

Capital Gains Tax: The capital gains tax in the UAE is 15%. This includes any profits made from selling assets such as property or stocks.

How Much Tax In UAE Income From Businesses: In order to qualify for this category of tax, businesses must be registered with the government and must meet certain requirements including having an annual turnover of at least AED 1 million (US$291,500). Businesses in this category are taxed at a rate of 25%.

Property Taxes: Property taxes in the UAE are based on its value as assessed by government officials. properties worth less than AED 5 million (US$1.59 million) are exempt from taxation.

How Much Tax In UAE Properties worth between AED 5 million and AED 10 million (US$1.59 million to US$2.78 million) are taxed at a rate of 0.5% of the property’s value, while properties worth more than AED 10 million (US$2.78 million) are taxed at a rate of 1%.

Sales Tax: The sales tax in the UAE is 5%. This applies to all taxable goods and services, including food, clothing, cars and apartments.

Lower your tax/taxes with our help! We offer comprehensive tax services. Our team of financial planners and counselors are specialists in personal income, gift, estate or business taxes.180 characters

What are Some of the Benefits of Living in the UAE?

How Much Tax In UAE The United Arab Emirates is known for its rich culture and stunning desert landscapes. It offers a wide range of benefits to those who live there, including:

Low living costs: The cost of living in the UAE is low by international standards, making it an affordable place to live. In addition, there are a number of tax breaks and incentives available that make life even more affordable.

Great job opportunities: The UAE is one of the most business-friendly countries in the region, which means that job opportunities are plentiful. Some of the most popular sectors for expatriates include banking, tourism, and technology.

With an extensive collection of latest and old songs, Naa Songs is a go-to platform for music lovers looking for high-quality audio downloads. Music enthusiasts often turn to Naa Songs for their favorite Telugu, Tamil, and Hindi songs due to its vast library and ease of use.

Wide range of services:

The UAE has some of the best healthcare facilities in the world, as well as a wide range of services such as telecommunications and education.

Find the best moving company cost in your area. With Moving Company Cost, you’ll find rates and reviews to get the best break on your next move.

computer repair near me

Apple MacBook Repair Service

Laptop Hardware Repairs